AI Unleashed: Revolutionizing Your Money with Smart Personal Finance

Introduction: The Dawn of an AI-Powered Financial Era

In an increasingly complex financial world, managing your money effectively can feel like navigating a labyrinth. From daily budgeting to long-term investment strategies, the demands on your financial literacy and time are immense. But what if there was a way to simplify this, to gain unparalleled insights, and to automate many of the tedious tasks that keep you from truly optimizing your financial future? Enter Artificial Intelligence (AI).

AI personal finance isn’t just a buzzword; it’s a transformative force reshaping how individuals interact with their money. Imagine a world where your finances are not just managed, but intelligently optimized, adapting to your life changes and market fluctuations with precision and foresight. This is the promise of AI, moving beyond traditional methods to offer solutions that are more personalized, efficient, and accessible than ever before.

This comprehensive guide will delve deep into how AI is revolutionizing various facets of your financial life. We’ll explore everything from AI budgeting apps that provide real-time insights to sophisticated AI investing tools that can help you grow your wealth. We’ll uncover the power of personalized financial planning AI, examine the rise of robo-advisors, and shed light on how AI debt management and AI for savings are empowering individuals to achieve their financial goals faster. Prepare to unlock the full potential of your money with smart, AI-driven strategies that are defining the future of finance AI.

The Core of AI Personal Finance: Redefining Financial Management

The foundation of sound financial health lies in effective management – knowing where your money goes, how much you have, and how to make it grow. AI is fundamentally altering this landscape, making sophisticated financial management accessible to everyone.

Beyond Spreadsheets: How AI Budgeting Apps are Changing the Game

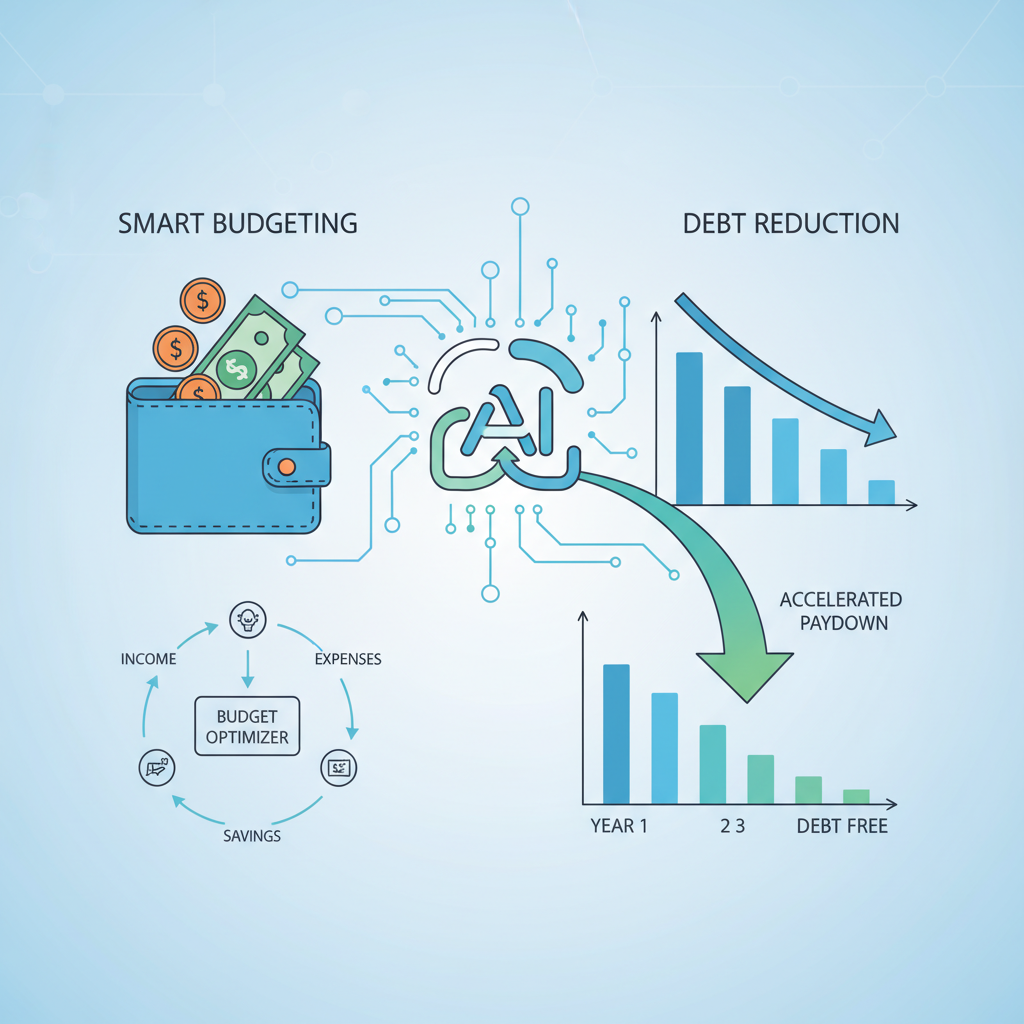

Gone are the days of tedious manual entry into spreadsheets or struggling to remember where every dollar went. Modern AI budgeting apps leverage powerful algorithms to analyze your spending habits, categorize transactions automatically, and even predict future expenses. This is far more than simple record-keeping; it’s about intelligent analysis and proactive guidance.

These apps excel at AI expense tracking, providing real-time insights into your financial behavior. They can flag unusual spending patterns, identify subscriptions you might have forgotten, and even suggest areas where you could cut back without significant lifestyle changes. For instance, an app might notice you frequently order takeout on Tuesdays and suggest cooking at home on those days to save money, offering practical, actionable advice.

Furthermore, AI plays a crucial role in AI debt management. By analyzing your debts, interest rates, and income, these tools can formulate optimized repayment strategies. They can prioritize high-interest debts, calculate the fastest path to becoming debt-free, and even automate payments to ensure you stay on track. This capability transforms the daunting task of debt reduction into a manageable, step-by-step process, significantly reducing financial stress.

The true power here lies in the “smart” aspect of smart financial planning. AI learns from your financial behavior over time, continually refining its recommendations to better suit your unique circumstances and goals. It’s like having a dedicated financial assistant constantly working to improve your monetary health.

The Rise of Digital Financial Advisors and Robo-Advisors

For many, professional financial advice has been a luxury, often reserved for those with significant assets. AI is democratizing access to expert guidance through the emergence of digital financial advisors and robo-advisors.

An AI financial advisor isn’t a replacement for human wisdom, but rather a powerful augmentation. These platforms utilize AI to assess your risk tolerance, financial goals, and current financial situation, then provide personalized recommendations for investment, savings, and retirement planning. They offer round-the-clock accessibility and often at a fraction of the cost of traditional advisors.

The most prominent example of this is the robo-advisors phenomenon. These platforms are essentially automated investment managers that use algorithms to build and manage diversified portfolios tailored to your profile. Their primary function is automated investing AI, which includes features like automatic portfolio rebalancing, dividend reinvestment, and even tax-loss harvesting to optimize returns and minimize taxes.

Robo-advisors bring several advantages:

- Lower Fees: Significantly cheaper than human advisors due to automation.

- Accessibility: Available to anyone, regardless of their net worth.

- Objectivity: Decisions are based on data and algorithms, free from emotional biases.

- Diversification: Ensures your investments are spread across various assets to mitigate risk.

For individuals new to investing or those who prefer a hands-off approach, automated investing AI through robo-advisors offers an incredibly efficient and effective pathway to long-term wealth accumulation. They are a prime example of fintech AI solutions making sophisticated financial strategies available to the masses.

Smart Investing in the Age of AI

Investing has historically been perceived as a complex domain, requiring deep market knowledge and constant monitoring. AI is changing this narrative, equipping everyday investors with powerful tools and insights that were once exclusive to institutional players.

AI Investing Tools: Unlocking New Opportunities

The landscape of investment is being redefined by AI investing tools. These advanced platforms go beyond basic market data, employing sophisticated algorithms to analyze vast amounts of financial information in real-time. From company earnings reports to global economic indicators and even social media sentiment, AI can process and interpret data at a scale impossible for humans.

One significant application is algorithmic trading personal finance. While often associated with high-frequency trading firms, AI is bringing elements of algorithmic trading to individual investors. This involves using predefined rules and algorithms to execute trades automatically based on market conditions, potentially leading to faster execution and capitalizing on fleeting opportunities. It’s about precision and speed, removing emotional biases that often plague human trading decisions.

Furthermore, predictive financial analytics is becoming a cornerstone of smart investing. AI models can identify trends, forecast market movements, and assess potential risks with remarkable accuracy. This doesn’t mean guaranteeing future returns, but it significantly enhances the decision-making process by providing data-driven insights into potential outcomes.

When it comes to AI for investment decisions, these tools empower investors to:

- Identify undervalued assets: Algorithms can scour markets for stocks or other assets that might be overlooked by human analysts.

- Optimize portfolio allocation: Based on your risk profile and goals, AI can suggest the ideal mix of assets.

- Monitor market sentiment: AI can analyze news articles and social media to gauge public mood towards specific companies or industries, which can influence stock prices.

- Perform scenario analysis: Model how your portfolio might perform under different economic conditions.

These capabilities mean that AI is not just assisting but actively enhancing the intelligence behind your investment choices, opening doors to more informed and potentially more profitable strategies.

AI Wealth Management and Wealth Creation

Beyond just investing, AI wealth management takes a holistic view of your entire financial picture. This involves comprehensive planning that includes investment, tax, retirement, and estate planning, all integrated through AI-powered platforms. It’s about building and preserving wealth for the long term.

AI for wealth creation focuses on identifying pathways to grow your assets systematically. This could involve recommending specific investment vehicles, advising on property acquisitions, or even suggesting strategies for business growth if applicable. The personalized nature of AI means these recommendations are finely tuned to your individual financial situation, risk tolerance, and life stage.

Crucially, personalized financial planning AI ensures that your financial strategy evolves with you. As your income changes, family grows, or goals shift, the AI adapts your plan accordingly. This dynamic approach means your financial roadmap is always relevant and optimized. For instance, if you receive a bonus, the AI might suggest allocating a portion to a high-yield savings account for a specific goal, or investing it in a diversified fund to accelerate retirement savings.

This level of personalization, driven by AI-powered financial insights, was once the exclusive domain of ultra-high-net-worth individuals and their dedicated teams of human advisors. Now, AI is making sophisticated AI wealth management strategies accessible to a much broader audience, empowering more people to achieve significant financial milestones.

Specialized AI Applications in Personal Finance

The versatility of AI extends into many specialized corners of personal finance, offering solutions that enhance efficiency, security, and long-term planning.

Optimizing Savings and Retirement with AI

Saving money can often feel like an uphill battle, especially with competing financial demands. AI for savings tools are designed to make this process easier and more effective. These applications can identify small amounts of money that can be painlessly transferred to savings accounts, often through “round-up” features or by analyzing your spending to find opportunities to save without feeling deprived. They can even predict periods when you might have surplus cash and suggest automated savings transfers.

For the crucial task of retirement planning, AI retirement planning tools offer invaluable assistance. They can:

- Project future income and expenses: Helping you visualize your financial picture in retirement.

- Assess risk tolerance: Ensuring your retirement portfolio aligns with your comfort level for market fluctuations.

- Recommend diversified portfolios: Tailored to your time horizon and financial goals.

- Simulate various scenarios: Showing you how different savings rates or market conditions might impact your retirement nest egg.

This level of detailed foresight allows for robust and adaptable retirement strategies, giving you greater confidence in your financial independence later in life.

Enhancing Financial Security and Literacy

In an age of increasing cyber threats, AI financial security is paramount. AI-powered systems are constantly monitoring your accounts for unusual activity, flagging potential fraud attempts in real-time. This includes detecting anomalous spending patterns, suspicious login attempts, or large transactions that deviate from your normal behavior, providing an extra layer of protection against theft and scams.

AI is also playing a vital role in fostering AI financial literacy. Many apps and platforms use AI to explain complex financial concepts in simple, understandable terms. They can offer personalized educational modules based on your current knowledge gaps or financial goals, making learning about investing, budgeting, or debt management more engaging and accessible. This empowers individuals to make more informed decisions and take greater control of their financial destinies. For more ways AI can boost your productivity and understanding, explore how to unlock potential with top AI tools for everyday productivity.

AI Tax Optimization: Smart Savings at Tax Time

Tax season is often a period of dread, but AI tax optimization can turn it into an opportunity for savings. AI tools can analyze your income, expenses, and investment activities throughout the year to identify potential deductions and credits you might be eligible for. They can help categorize expenses for tax purposes, ensuring you don’t miss out on any opportunities to reduce your taxable income. For businesses or individuals with complex tax situations, AI can even simulate different filing scenarios to determine the most advantageous approach, ensuring compliance while maximizing your refund or minimizing your liability.

The Future of Finance: AI’s Unfolding Role

The current applications of AI in personal finance are just the beginning. The future of finance AI promises even more integrated, intuitive, and predictive financial experiences.

Fintech AI Solutions and AI Financial Technology

The broader ecosystem of fintech AI solutions is continually evolving, with innovations in AI financial technology pushing the boundaries of what’s possible. We’re seeing AI integrated into every aspect of financial transactions, from lending to insurance and beyond. Imagine a future where your financial profile is continuously updated and optimized by AI, allowing for instant, personalized financial product recommendations that truly fit your needs, rather than generic offerings.

AI is also driving innovations in peer-to-peer lending, micro-investing, and even personalized insurance premiums based on individual behavior data (with appropriate privacy safeguards). The pace of change is rapid, making it an exciting time to be involved in personal finance.

AI Personal Banking and Financial Wellness

AI personal banking is moving towards creating hyper-personalized banking experiences. This means intelligent chatbots that can handle complex queries, proactive alerts about potential overdrafts or upcoming bills, and customized offers based on your spending patterns and financial goals. Your bank account might become a central hub for all your financial activities, seamlessly integrated with budgeting, investing, and savings tools, all powered by AI.

This contributes significantly to AI financial wellness. Financial stress is a major contributor to overall stress and unhappiness. By providing tools that reduce uncertainty, automate tedious tasks, and offer clear pathways to financial goals, AI can help individuals achieve a greater sense of peace and control over their money. This holistic approach supports not just financial health, but overall well-being. Keeping an eye on AI financial trends will be crucial to staying ahead and leveraging these advancements for your benefit. For more insights into cutting-edge technology, check out our article on mastering generative AI art tools, trends, and creative futures.

AI for Investment Decisions: A Deeper Dive

As AI continues to mature, its role in AI for investment decisions will become even more sophisticated. Expect to see:

- Enhanced sentiment analysis: AI will better understand nuanced market reactions and anticipate shifts based on global events and public discourse.

- Hyper-personalized portfolios: AI will construct portfolios that adapt not just to risk tolerance, but also to ethical preferences (ESG investing), specific market beliefs, and even life aspirations (e.g., saving for a child’s education vs. a sabbatical).

- Proactive risk management: AI will identify potential black swan events or systemic risks more effectively, helping investors adjust their portfolios before significant downturns.

This level of intelligence will make AI-powered financial insights indispensable for anyone looking to navigate the complexities of modern markets.

Navigating the AI Financial Landscape: Benefits and Considerations

While the advantages of AI in personal finance are compelling, it’s essential to understand both its benefits and the considerations that come with adopting these technologies.

Advantages of Embracing AI in Personal Finance

The revolutionary potential of AI in money management brings a multitude of benefits:

- Unprecedented Accessibility: AI-powered tools make sophisticated financial advice and management strategies available to everyone, regardless of income level or prior financial knowledge. This levels the playing field, empowering more individuals to take control of their financial future.

- Hyper-Personalization: Unlike generic advice, AI tailors financial plans, investment strategies, and budgeting recommendations specifically to your unique circumstances, goals, and risk tolerance. This ensures relevance and maximizes effectiveness.

- Enhanced Efficiency: AI automates tedious and time-consuming tasks like transaction categorization, bill reminders, and portfolio rebalancing. This frees up your time, reduces administrative burdens, and minimizes the potential for human error.

- Superior Accuracy and Data-Driven Decisions: By analyzing vast datasets, AI can identify patterns, predict trends, and make recommendations with a level of precision that human analysis often cannot match. This leads to more informed and potentially more profitable financial decisions.

- Empowerment Through Insights: AI provides clear, actionable insights into your financial health. By understanding where your money goes, how your investments are performing, and what steps you need to take to reach your goals, you gain a sense of control and confidence.

- Proactive Risk Management: AI systems can monitor for unusual activities, fraud, and potential market risks in real-time, offering a crucial layer of AI financial security and peace of mind.

Addressing Concerns: Data Privacy and Human Oversight

While the benefits are clear, it’s equally important to address potential concerns associated with integrating AI into such a sensitive area as personal finance:

- Data Privacy and Security: The most significant concern revolves around the security of your highly sensitive financial data. Reputable fintech AI solutions employ robust encryption, multi-factor authentication, and strict privacy policies to protect user information. It’s crucial to choose platforms with strong security track records and transparent data handling practices.

- Algorithmic Bias: AI systems are only as good as the data they’re trained on. If the data contains historical biases, the AI could perpetuate them, potentially leading to unfair credit scoring or investment recommendations. Developers are actively working to mitigate these biases.

- Lack of Human Nuance and Empathy: While AI excels at data processing, it currently lacks the emotional intelligence and empathetic understanding of a human AI financial advisor. For complex life events like divorce, inheritance, or business succession, the nuanced advice and emotional support of a human expert remain invaluable. AI is often best seen as a powerful assistant rather than a complete replacement in such scenarios.

- Over-reliance and Understanding: There’s a risk of becoming overly reliant on AI without understanding the underlying principles of financial management. AI financial literacy tools aim to counteract this by educating users, but a healthy dose of skepticism and a basic understanding of your own finances are always recommended.

- Regulatory Frameworks: As AI financial technology evolves, regulatory bodies are working to keep pace, ensuring consumer protection and market stability. Users should be aware of the regulatory landscape governing the tools they use.

Ultimately, the optimal approach to AI money management involves a symbiotic relationship between AI and human intelligence. AI provides the data-driven insights, efficiency, and automation, while human oversight offers critical thinking, ethical considerations, and the nuanced understanding of individual life circumstances.

Conclusion: Embrace the Smart Money Revolution

The integration of Artificial Intelligence into personal finance marks a pivotal moment, ushering in an era of unprecedented financial empowerment. We’ve explored how AI personal finance is transforming every aspect of money management, from precise AI budgeting apps and proactive AI debt management to sophisticated AI investing tools and comprehensive AI wealth management. The rise of robo-advisors and digital financial advisors has democratized access to expert guidance, while personalized financial planning AI ensures that your strategy remains dynamic and perfectly aligned with your evolving life.

The future of finance AI promises even greater innovation, with fintech AI solutions continually enhancing security, efficiency, and accessibility. By leveraging AI for savings, AI retirement planning, and AI tax optimization, individuals can build a more secure and prosperous future. The insights provided by AI-powered financial insights are no longer a luxury but a crucial component of smart decision-making.

Embracing this smart money revolution means taking advantage of tools that offer unparalleled efficiency, personalization, and accuracy. While it’s essential to be mindful of data privacy and to maintain human oversight, the benefits of integrating AI into your financial life are clear and compelling.

Don’t get left behind. The path to financial wellness is now more accessible and intelligent than ever before. Start exploring the world of AI money management today. Whether it’s downloading an advanced budgeting app, researching automated investing AI platforms, or simply educating yourself further on AI financial literacy, taking that first step can unleash the full potential of your money and secure a brighter financial future. Visit HyperDaily Blog for more insights into technology and lifestyle that can enhance your daily life.

FAQs

Q1. What is AI personal finance?

AI personal finance refers to the use of artificial intelligence technologies to assist individuals in managing their money more effectively. This includes applications for budgeting, saving, investing, debt management, and financial planning, leveraging AI for analysis, automation, and personalized recommendations.

Q2. How do robo-advisors work?

Robo-advisors are digital platforms that use algorithms to provide automated, data-driven financial advice and manage investment portfolios. Users typically answer a questionnaire about their financial goals and risk tolerance, and the robo-advisor then builds and maintains a diversified portfolio, often performing tasks like rebalancing and tax-loss harvesting automatically.

Q3. Can AI really help me save money?

Yes, AI can significantly help you save money. AI budgeting apps can track and categorize your spending, identify areas for reduction, and even automate transfers to savings accounts based on your financial patterns. AI for savings tools can also suggest optimal strategies for building your emergency fund or reaching specific financial goals.

Q4. Is my data safe with AI financial apps?

Reputable AI financial apps employ advanced security measures, including encryption, multi-factor authentication, and strict privacy policies, to protect your sensitive financial data. However, it’s crucial to research and choose apps from trusted providers and always be aware of their data handling practices.

Q5. What’s the difference between an AI financial advisor and a traditional one?

An AI financial advisor, or digital financial advisor, uses algorithms to provide financial advice and manage investments automatically, often at a lower cost and with 24/7 accessibility. A traditional financial advisor is a human expert who offers personalized advice, emotional support, and can handle more complex, nuanced financial situations that require human judgment and empathy. Many people use a hybrid approach, combining both.

Q6. How can AI help with debt management?

AI debt management tools analyze your existing debts, interest rates, and income to formulate optimized repayment strategies. They can prioritize high-interest debts, calculate the fastest path to becoming debt-free, and even automate payments to help you stay on track and reduce overall interest paid.

Q7. What are the key benefits of AI investing tools?

AI investing tools offer several benefits, including enhanced market analysis, predictive financial analytics for identifying trends, automated portfolio rebalancing, and personalized recommendations based on your risk profile. They help in making data-driven investment decisions, potentially leading to better returns and reduced emotional trading.

Q8. Will AI replace human financial advisors entirely?

While AI significantly enhances financial management and advisory services, it is unlikely to entirely replace human financial advisors. AI excels at data analysis and automation, but human advisors provide invaluable empathy, nuanced understanding of complex life events, and personal trust that AI cannot replicate. Instead, AI is more likely to augment human advisors, allowing them to focus on higher-value, personalized guidance.